Compounding interest is perhaps one of the most important drivers when it comes to building your wealth. Not only is your principal earning interest, but so is that interest! Compounding interest works in your favor as an investor time and time again and continues to be more impactful the longer you allow your investments to work for you.

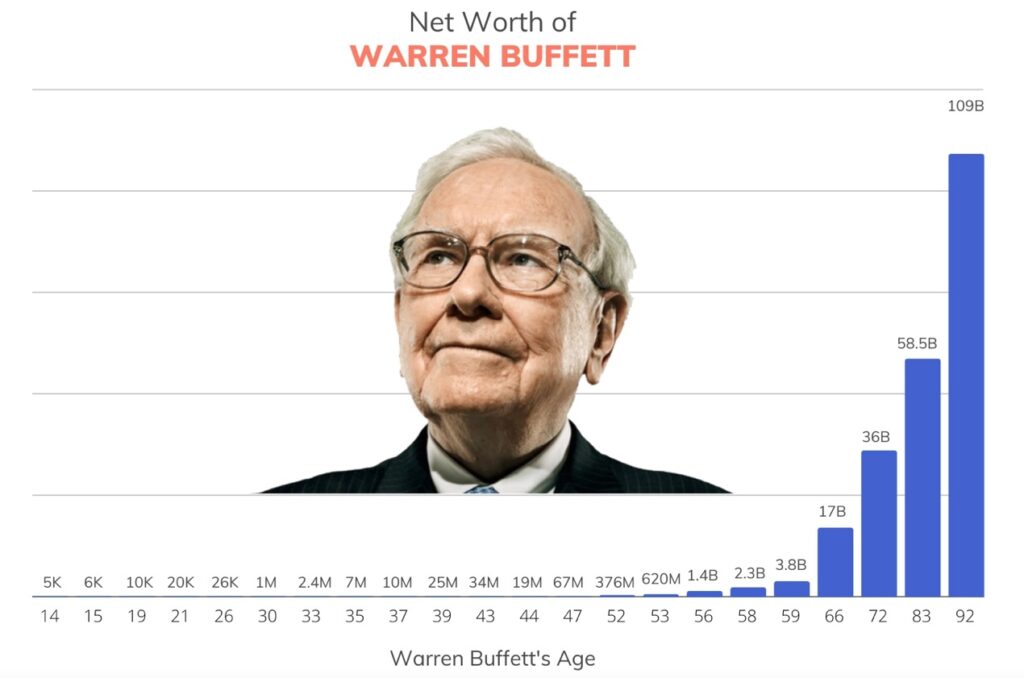

Many know who the Oracle of Omaha is, Warren Buffett. Mr. Buffett is one of the most successful investors in the world. Warren Buffett started investing at the young age of 15, and at 92 Buffett’s wealth has continuing to grow more and more each year. The secret behind his success… compounding interest.

Realizing this strategy at an early age Mr. Buffett has been able to make his money work for him repeatedly each and every year. Mr. Buffett has been able to grow his personal net worth to several billions of dollars year after year and has compounding interest to thank for that.

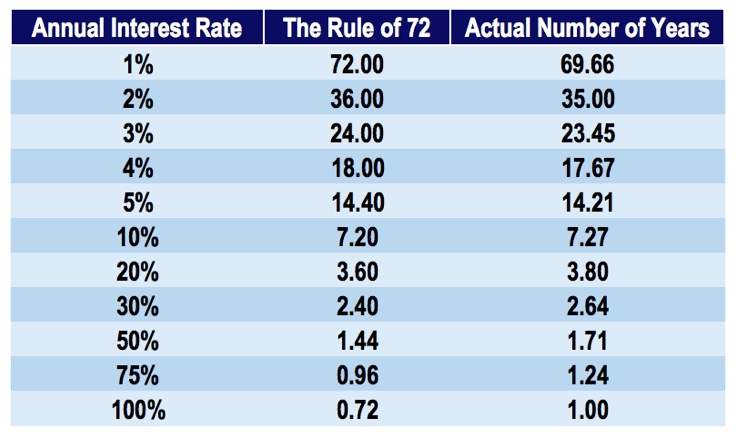

One way to measure compounding interest is with the rule of 72. The rule of 72 is a great tool for you to calculate how many years it will take you to double your money based on the rate of return.

Simply take 72 and divide it by the rate of return; the solution will be the number of years it will take to double your investment. (Example: 10% annual return/72 = 7.2 years to double or compound your initial investment)

You often hear us preach “save early, save often.”

Building your wealth requires letting your investments and interest compound for long periods of time! Remember it’s better to have time in the market than trying to time the market. Keep saving and investing and give compounding interest time to work.

If you’re interested in learning more about how to get started making compounding interest work for you, please reach out to our office today!