Did you know there’s a little-known tax trick that could save your beneficiaries thousands of dollars? It’s called the “stepped-up basis,” and it’s super useful for anyone inheriting assets like stocks, real estate, or other investments.

What is a Stepped-Up Basis?

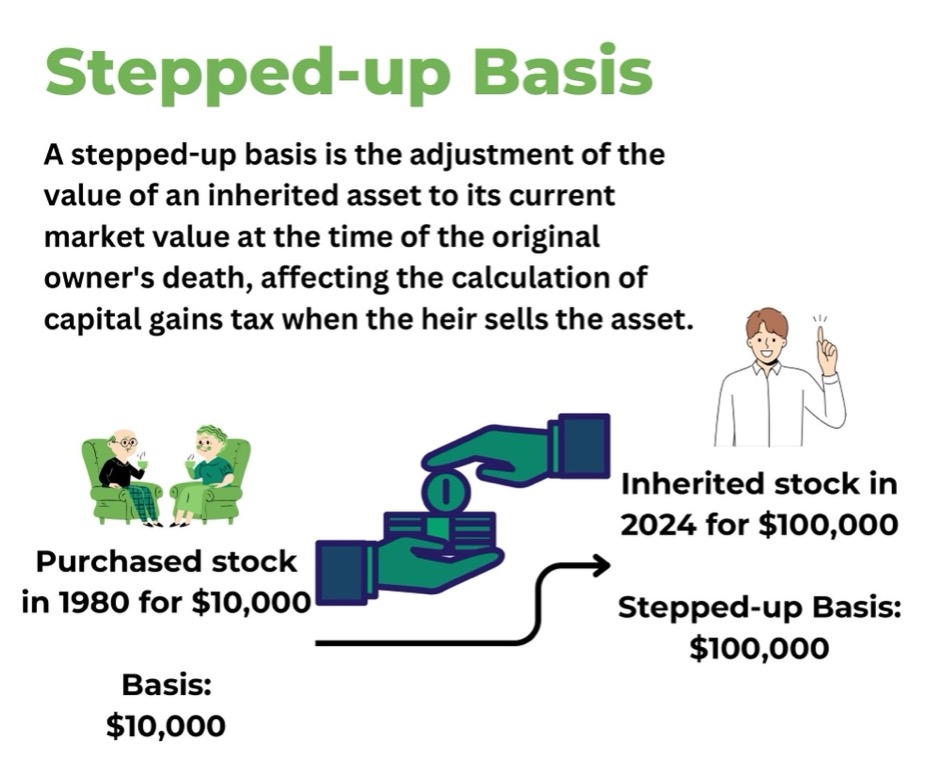

A stepped-up basis adjusts the value of an inherited asset to its current market value at the time the original owner passes away. Let’s break it down:

The original basis is the value of the asset when the decedent purchased it, for instance, $10,000 for a stock. When the decedent dies, this value is updated to the market value at that time, so if the stock is worth $100,000 upon their death, the heir’s basis is stepped up to $100,000. When the heir sells the inherited asset, the capital gains tax is calculated based on this stepped-up basis, meaning they only pay taxes on any increase in value from the stepped-up basis—so if they sell the stock for $110,000, they pay taxes on just the $10,000 increase, not on the original $90,000 gain.

Why is this important?

The stepped-up basis can significantly reduce the capital gains tax your heirs might have to pay. Instead of being taxed on the entire increase in value from when the asset was first purchased, they’re only taxed on the increase from the value at the time of inheritance.

Having a clear plan in place also helps prevent any confusion or disagreements among your beneficiaries. Since the trust lays out who gets what, there’s less room for arguments or misunderstandings. It’s like having a roadmap that guides everyone to their rightful share, making the process smoother for everyone involved.

Ensuring Your Heirs Get a Stepped-Up Basis

Here are some tips to make sure your accounts are set up correctly so your heirs benefit from a stepped-up basis:

- List Beneficiaries: Always include beneficiaries on all your assets and investment accounts. It’s easy to forget, but keeping this information updated ensures your heirs get the benefits they’re entitled to.

- Proper Asset Titling: Make sure your assets are titled correctly. Your estate or you should own the assets to ensure a stepped-up basis applies. Avoid adding your children as joint owners to your house or investment accounts thinking it’s a safe way to transfer assets. Doing this can result in no stepped-up basis, meaning your heirs might face hefty taxes based on the original purchase price instead of the inherited value.

Understanding and utilizing a stepped-up basis can save your heirs a lot of money in taxes. By properly setting up your accounts and correctly titling your assets, you can ensure they get the maximum benefit and avoid unnecessary tax burdens. Take these simple steps now, and you’ll be doing your loved ones a big favor in the future.