As the holiday festivities come to a close and a new year begins, it’s an ideal time to adjust your financial direction. At Wisely Advised, we know that a new year brings not only resolutions but also opportunities for significant lifestyle changes. Embracing financial empowerment, this is the perfect moment to review your financial plans and head into 2024 with fresh objectives.

Adjusting Your Finances in Response to Life Changes

The previous year brought about various significant life events, including weddings, parenthood, the arrival of grandchildren, career milestones, and retirement. Regardless of the chapter you are currently navigating, it’s crucial to examine how these milestones will impact your financial situation.

Getting on Track With Your Budget

In January, many find themselves grappling with the challenge of managing debt. Kickstart the new year on a positive note by taking control of your debt. A prudent approach involves initiating the process by settling smaller debts first. Remember the age-old adage: “A borrower is a slave to the lender.” By managing and minimizing your debts, you empower yourself to achieve greater financial freedom.

Investment Reflection:

The beginning of the year is a great time to assess your investments and retirement plans. Following the events of the previous year, it’s wise to evaluate the performance of your financial portfolio. Keep in mind that markets operate beyond our control. Variables such as the actions of the Federal Reserve, geopolitical wars, and inflation are external factors beyond our influence. Change is the principle that holds true regardless of your life stage. Recognizing that life is always changing, discussions about potential reevaluation or adjustments to your investment allocation can be initiated early in the year. Having this conversation at the beginning of the year lays a foundation for financial success throughout the new year.

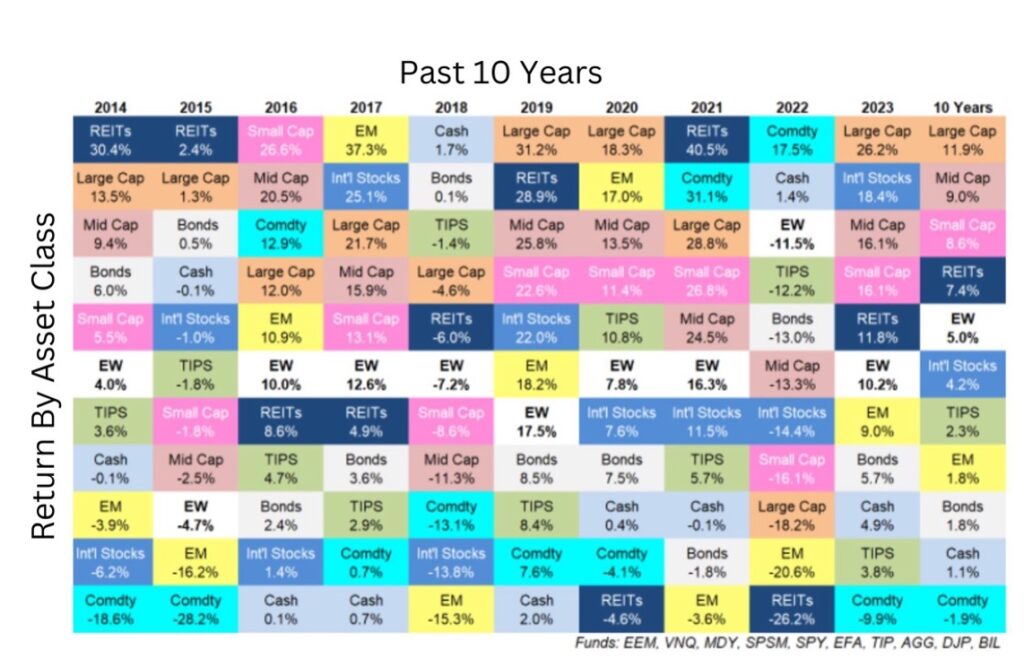

Remain Diversified:

In 2024, diversification remains crucial for navigating global uncertainties. Both investors and businesses adopt diversified approaches to spread risks and optimize returns. In a rapidly changing landscape, diversification is not just a risk management tool but a proactive measure that enhances adaptability and resilience. Balancing innovation with stability, and diversification continues to be integral for success across various domains in 2024. Here is how Diversification by asset class has changed over the past 10 years.

Ensure A Solid Estate Plan:

As we step into the new year, it’s an opportune moment to examine your estate plan, ensuring it aligns with your present financial goals and family dynamics. This thoughtful evaluation sets the stage for a secure and tailored approach to the overall financial picture, providing the foundation for your financial well-being and legacy aspirations in the years ahead.