Despite the importance of estate planning, shocking statistics reveal a significant gap in preparedness across different age groups. Only 46% of individuals over age 55 have an estate plan, while just 26% of those aged 18-34 and 27% of individuals aged 35-54 have taken this crucial step. This mistake shows something really important about money planning that many Americans forget—the need to have basic protections in place for themselves and their assets. An estate plan is key to your finances, protecting your assets during life and ensuring a smooth transfer after you’re gone. Notably, trusts emerge as highly effective tools in protecting assets from the processes of probate proceedings.

What is a Trust?

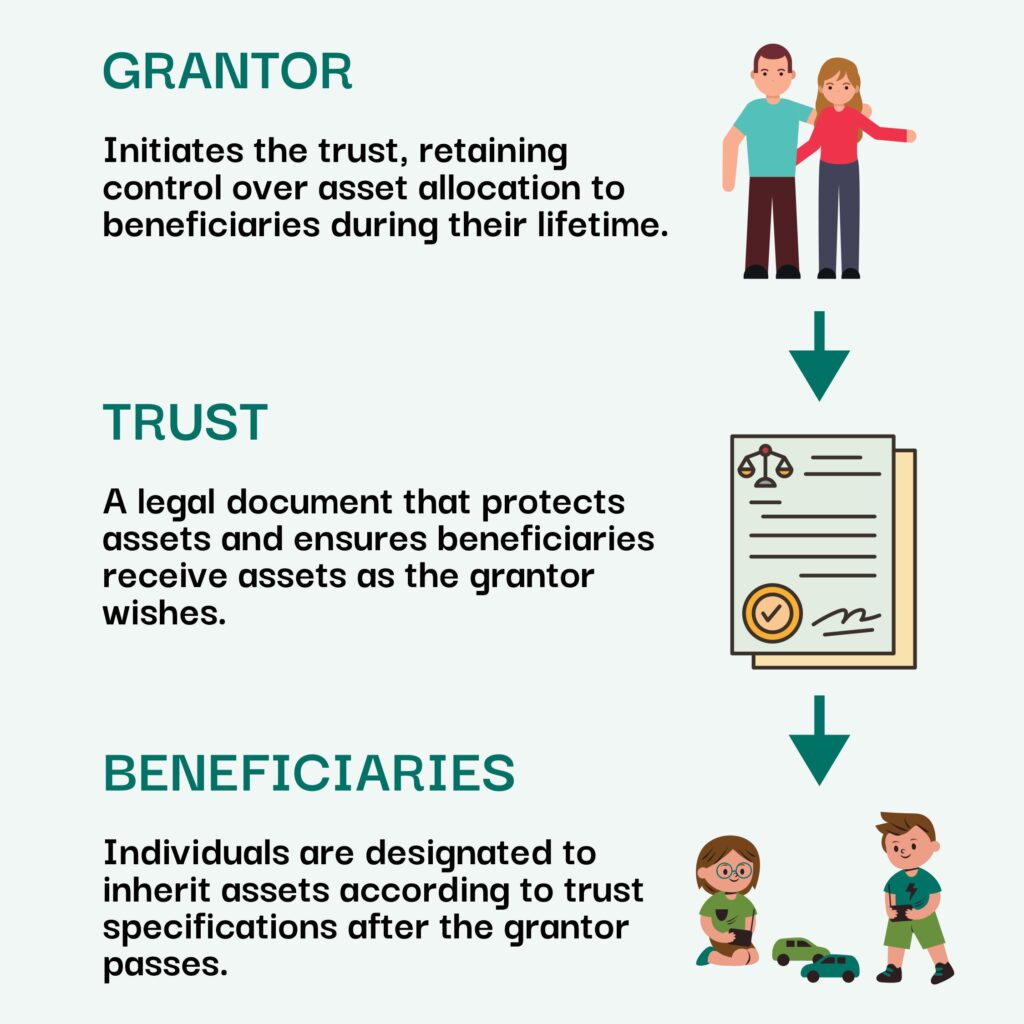

Let’s break down the concept of a trust in simpler terms. It is a legal tool to safeguard your assets, keeping them out of potential legal disputes or lengthy probate processes. There are three key players involved:

Grantor

Firstly, you have the Grantor, which is you—the one setting up the trust. This control remains intact throughout your lifetime, offering reassurance to many individuals by enabling them to customize the trust according to their specific wishes and circumstances. Additionally, retaining control over the trust assets empowers you to make necessary changes or adjustments over time.

Trustees

In addition to the Grantor, there’s the Trustee, who serves as the administrator of the trust. Often times the Grantor assumes the role of trustee during their lifetime. The Trustee’s primary responsibility is to ensure that all aspects of the trust are administered precisely according to your instructions, without any deviation. They have a legal obligation to act in the best interests of the trust and its beneficiaries. This includes tasks like investing trust assets, distributing income or principal to beneficiaries as directed, and ensuring that all administrative tasks are carried out properly. Choosing the right Trustee is crucial, as they play a pivotal role in the ongoing management and success of the trust.

Beneficiaries

Lastly, there are the Beneficiaries, the individuals you’ve designated to receive assets from the trust after you pass away. You have the flexibility to designate beneficiaries according to your wishes, whether they’re family members, friends, charities, or even pets. You can also specify how and when beneficiaries receive their inheritance, whether it’s outright distributions, staggered payments, or other conditions. By clearly outlining your intentions for the beneficiaries in the trust document, you can help prevent confusion or disputes down the line and ensure that your assets are distributed according to your wishes.

Why Have Trust?

Let’s break down the concept of trust a bit further. Just like you value privacy for your personal data, establishing a trust is all about safeguarding your assets. It’s like putting a lock on your belongings to keep them private, both while you’re alive and after you’re gone. This way, only your chosen beneficiaries know what you have, ensuring your assets stay confidential even in your absence.

Life is full of changes, right? Maybe you buy a new house, start a family, or become a grandparent. These milestones can impact your assets and who you want to leave them to. That’s why it’s crucial to keep your estate plan updated. By regularly reviewing and adjusting your plan, you can make sure it reflects your current circumstances and wishes. This way, when you pass away, your assets are distributed exactly as you want them to be.

Having a clear plan in place also helps prevent any confusion or disagreements among your beneficiaries. Since the trust lays out who gets what, there’s less room for arguments or misunderstandings. It’s like having a roadmap that guides everyone to their rightful share, making the process smoother for everyone involved.

Let Us Help

If you haven’t yet assessed your existing estate plan, now is the opportune moment. If you haven’t had the chance to establish a Will or Trust, please contact our office. We have established agreements with local estate planning attorneys who can assist you in crafting these essential documents.